Condo Insurance in and around Laurel

Looking for excellent condo unitowners insurance in Laurel?

Cover your home, wisely

Calling All Condo Unitowners!

Are you stepping into condo ownership for the first time? Or have you owned one for a while? Either way, it can be a good idea to get coverage for your condo with State Farm's Condo Unitowners Insurance.

Looking for excellent condo unitowners insurance in Laurel?

Cover your home, wisely

Safeguard Your Greatest Asset

Things do happen. Whether damage from freezing pipes, smoke, or other causes, State Farm has terrific options to help you protect your condo and personal property inside against unpredictable circumstances. Agent Jay Young would love to help you build a policy that is personalized to your needs.

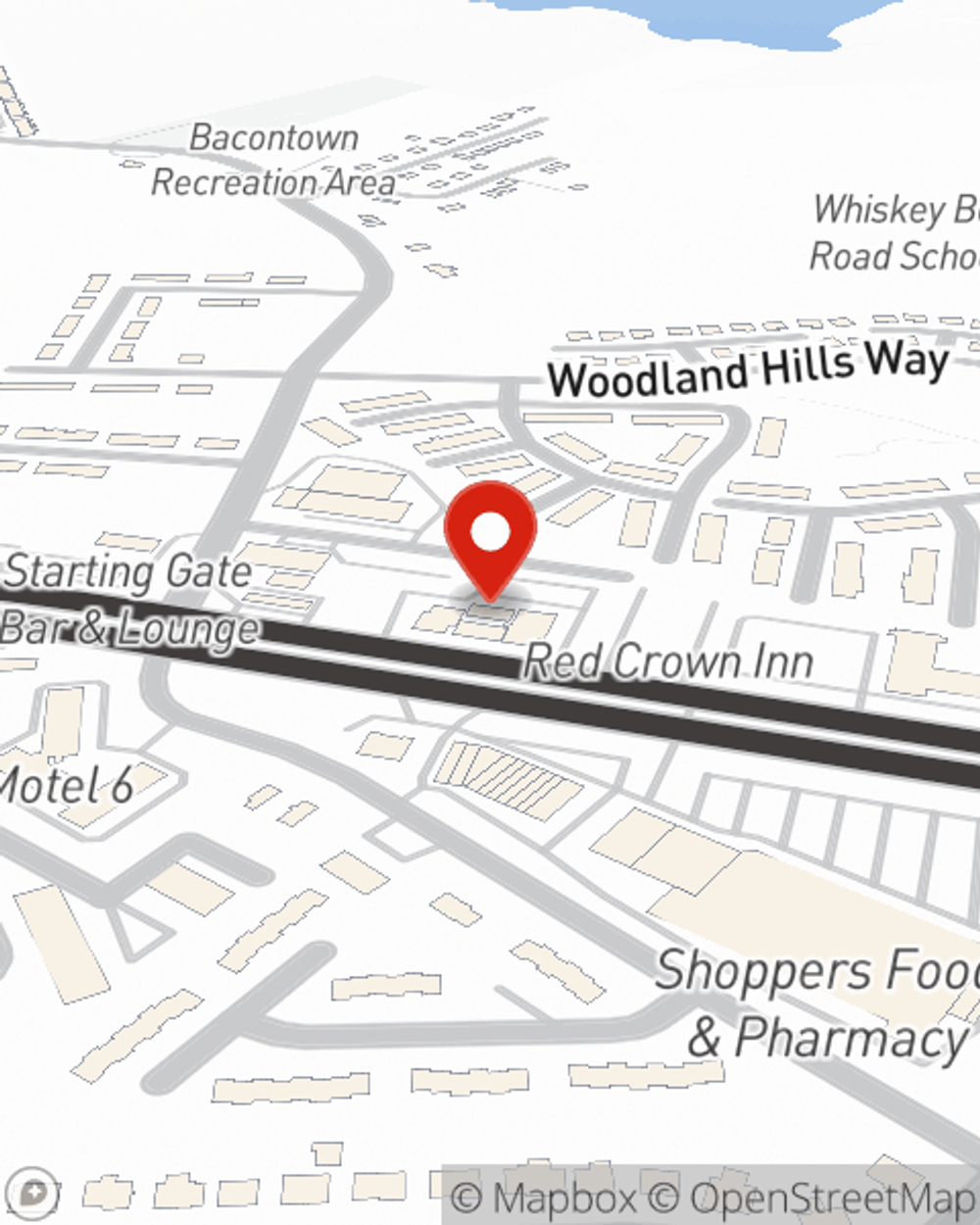

Getting started on an insurance policy for your condominium is just a quote away. Call or email State Farm agent Jay Young's office to explore your options.

Have More Questions About Condo Unitowners Insurance?

Call Jay at (301) 289-3140 or visit our FAQ page.

Simple Insights®

How to spot a roof leak and what to do if you have one

How to spot a roof leak and what to do if you have one

From mold on the roof to missing shingles, learn how to find roof leaks and know what to do.

Tips for dealing with lead paint

Tips for dealing with lead paint

Homes built before 1978 might contain lead-based paint -- one of the most common causes of lead poisoning, according to the Environmental Protection Agency.

Simple Insights®

How to spot a roof leak and what to do if you have one

How to spot a roof leak and what to do if you have one

From mold on the roof to missing shingles, learn how to find roof leaks and know what to do.

Tips for dealing with lead paint

Tips for dealing with lead paint

Homes built before 1978 might contain lead-based paint -- one of the most common causes of lead poisoning, according to the Environmental Protection Agency.